An Insight Into Moonfire's Portfolio Construction

During the shortest month of the year, we've still got plenty to share from Moonfire.

It remains an extraordinary time in tech with numerous parts of our tech world showing signs of being at unique inflection points aided by a pandemic that is driving forward a rate of digitalisation of our economy like we have never seen before. This has accelerated both the creation and growth rates of highly scalable startups, driving further capital into the sector even upstream to seed financing. It's a unique period in Europe that will probably be sustained over the long run.

Over the past few weeks, we’ve been working together as a team on portfolio construction and reasoning more deeply about the strategic aspects of fund size, check size, etc. In this newsletter, we’d like to share some details on our thinking here.

Insights into Moonfire's portfolio construction

With the start of the year we took a closer look at our fund model and did some scenario planning to compare where we are to where we want to be.

Fund size as a strategy

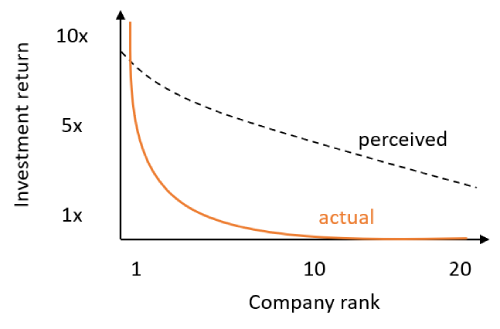

Tech investing is affected by the power law distribution where your best investment is worth more than your whole fund while the returns from your next best investment is half as impactful and so on. This accepted wisdom has been spoken about at length and defines the industry we are in.

It also impacts how we think about our fund size to balance portfolio diversity and ownership goals. A fund needs to be big enough to allow you to obtain diversification (shots on goal) that have the potential to be outliers. However, one also needs to achieve ownership levels that lets the magnitude of the biggest exit have enough impact to drive that outsized return.

Deciding on a specific fund size for a seed fund in Europe determines the level of diversification and ownership you can achieve. With our Fund I we aim to make 30-35 investments. This should allow us to get significant ownership, be sufficiently diversified and return funds to our LPs within a reasonable time.

Portfolio allocation and construction drive returns as much as company selection

In order to understand the number of possible investments your fund can make you need to set a strategy on the amount that you want to invest. For our core and non-core investments we plan completely without recycling. This gives us a good understanding of the number of investments we can and should plan to do. Our follow-on reserves could then potentially be topped-up with recycling and thus the number of follow-ons can vary.

Getting recycling right - always hard to forecast

Investing 100%, or even more, of the entire fund is not straightforward and requires planning. Recycling can allow you to invest more than 100% of the fund. In order to do so you need to have some early returns/exits, which is generally more difficult for early-stage funds because (significant enough) returns, compared to later stage investments, tend to materialise later and hence might be available too late.

Understanding your loss ratio

As it is with VC, you expect to have investments that are lost, some that break even and some that drive outsized fund returns. If you want to minimise fund losses, you are likely not taking enough risks while it is also not recommendable to place your bets on only a few companies. At Moonfire, we strive to focus on our core investments while we monitor our non-core investments closely in order to be ready and convert these into a core investment, if appropriate. We assume that one third of our core investments become winners and one of those should more than pay back the fund.

Ownership is key to delivering outsized fund returns

It is important to understand what your investments buy you in terms of ownership because you can e.g. do many investments aiming for relatively low ownership or fewer investments that buy you more ownership. Not only the entry-ownership is important but also the exit-ownership and thus the dilution from the subsequent investment rounds. All these assumptions allow you to calculate enterprise values for which the companies should be sold in order to return the fund.

Have a fund model but continue to model your outcomes scenarios

We have a clear fund model but that does not stop us from using our model to test the sensitivity of our assumptions. It’s easy to forget the impact of decisions if you move outside your model. By plugging in different scenarios we see pretty clearly what our new assumptions have to be. With an ever changing world it’s important to reinforce your north star.

Meet HiPeople and Oliva

HiPeople is an HR tech startup based in Berlin that wants to automate the reference checking process. Its mission is to enable better hiring by automatically collecting and analyzing talent data, and providing rich insights. HiPeople currently solves this by automating candidate reference checks from request, to collection, and analysis. This allows companies to extend the information they have on a candidate without additional manual work. Find out more by reading the recent TechCrunch article.

Oliva aims to offer meaningful online therapy for busy people. Its mission is to make mental healthcare a natural part of modern daily life by removing the fear and uncertainty from the clinical, complex process of seeking care. Oliva enables one to make real progress towards their goals with expert-curated therapists, personalised matching by certified experts, focused one-hour sessions, and a hassle-free online experience.

Moonfire Zoom series

In 2021, the Moonfire Zoom Series will feature leaders covering topics that are front of mind for founders as they define their foundational principles such as team culture, design, growth marketing, product market fit.

2021 kick-off with Cristina Berta Jones

To start the year, Cristina Berta Jones was our first guest to focus on expansion and growth. She joined Naspers as one of their top dealmakers where she invested in consumer businesses around the world. Cristina is now the COO of PICNIC where she is solving one of the most difficult challenges in e-commerce — to bring an online grocery offering centered on affordability, high-quality delivery service and environmental sustainability to the world.

More to come

In March, Matt Lerner will be hosting his “Finding Product Market Fit” workshop with our founders. He spent 15 years as a “growth marketer,” 10 years at PayPal, and is a Partner at 500 Startups. In April, we will be joined by Daniel Bay, the Head of People at GOAT, to talk about the culture and hiring from day 1.

Thanks for reading, I hope you have enjoyed catching up on our latest news and keep an eye out for next month's edition.

Best,

Mattias

🌓🔥