A Very Happy New Year From Moonfire

Happy new year all, because we've got the first Moonfire roundup of 2021 here for you.

A very happy new year! I hope you had a joyful and restful holiday season. I am excited to share with you what we have achieved in our first nine months at Moonfire.

Moonfire has launched:

- Moonfire’s been in operation for 10 months

- We’ve made 10 investments

- We have already achieved 2 up rounds & built strong syndicate investors

- Candice Lo and Mike Arpaia joined the team

- Our software is now tracking 1.2m people, 1.1m companies and there is more to come

Our first 10 months

We launched Moonfire in March 2020, to build a new generation venture capital firm focused on European seed. We set out to invest in the best and brightest founders to help them at the very beginning of their journeys. The growth of the ecosystem has required us to replace the manual, inefficient and incomplete approach with a data driven investment strategy, which makes better decisions, improves the workflow and can scale across Europe. Our focus is on the four sectors where we have the most experience - Capital & Finance, Work & Knowledge, Gaming, Community & Leisure and Health & Wellbeing - to help build the next generation of breakout founders.

10 investments already showing signs of success

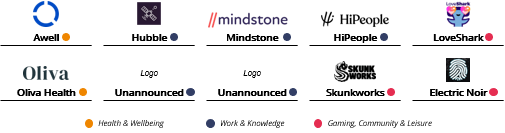

In 10 months we invested in 10 companies that we are incredibly proud of. Already, we are seeing up rounds helping drive our performance beyond what we expected and all indications are that the current portfolio will continue to perform.

| |||

| |||

|

| ||

|

|

A growing team

We are only as good as our team and are extremely fortunate to be surrounded by a carefully selected and complementary group of people, each with their own unique experiences to draw upon.

Candice Lo - Operational expert with investor experience

We are extremely excited to announce that Candice Lo has now joined Moonfire as a Venture Partner on the investment side. She is an active angel investor, who helped build Blossom Capital at inception, and prior to that worked at Uber for five years. Candice has launched countries from scratch and scaled in hyper growth, competitive, regulatory-challenged environments. Her operating knowledge from growing Uber across China and partnerships in EMEA provide her with a unique experience of building companies at scale, and give her a truly global network of former Uber alumni.

Mike Arpaia - Technical architect, former founder with strong investment interest

As a Moonfire Partner, Mike Arpaia complements the team with experience in building early-stage start-ups and contributing to industry-leading tech companies. With his computer science background and long harboured passion for venture capital and quantitative finance, Mike is responsible for the definition and delivery of the firm’s technology strategy. He works on architecting and engineering our software, sourcing and processing massive datasets and developing machine learning solutions to problems all throughout the investing lifecycle.

The Moonfire software is coming into its own

"When you have access to the world’s largest datasets … it would be foolish to just go out and make gut investments.” Bill Maris

Moonfire's approach to leveraging data to get a competitive advantage and drive outperformance is what distinguishes us as a firm. We believe starting a firm that is data driven from the ground up can change how venture is done. We want to remove the limitations of venture and be able to scale as this industry grows in size. Moonfire is using machine learning to source, screen and evaluate opportunities. We prioritise better, move faster and make better investment decisions. We use these tools to enhance our processes and help augment traditional seed investing methods with a data driven approach, which we believe will improve our sourcing, evaluating and portfolio management. Our Moonfire software is now currently tracking:

- 1.2 million people

- 1.1 million companies

- 170,000 investors

Thanks for reading and keep an eye out for next month's edition.

Best,

Mattias

🌓🔥