A New Moonfire Project - Open-Source Tokenomics

As ever, this month has been busy for us at Moonfire. But with the sun finally emerging from its winter slumber, I type this newsletter with an invigorated spring in my fingers.

As ever, this month has been busy for us at Moonfire. But with the sun finally emerging from its winter slumber, I type this newsletter with an invigorated spring in my fingers.

We have an exciting open-source project to announce. We will also introduce two more fantastic recruits to the Moonfire team.

Let’s get to it!

A New Moonfire Project - Open-Source Tokenomics

At Moonfire, we spend a lot of our time reading whitepapers and pitch decks for crypto / web3 projects, both past and future.

When evaluating a project and predicting its trajectory, many factors need to be considered, including:

- How is the initial pool of tokens distributed among different stakeholders?

- What rights derive from holding a token?

- How token allocations are vesting and over what time period?

- What blockchain is it on?

- Do the tokens have a fixed maximum supply?

Projects need to be able to provide satisfactory answers to the questions above because they can have important ramifications for the incentive structures and ultimately the long-term success of a project.

Different token distributions create unique sets of trade-offs and incentives, some obvious, others more subtle. We want to know which distributions encourage long-term thinking, and which allow for a quick pump-and-dump? Will an airdrop help incubate a thriving community or just stoke resentment for latecomers, shut out from decision-making?

We want to find answers to these questions and more besides. And, being a data-driven organisation, we want to do that with real data.

Unfortunately, right now there isn’t a dataset available on token distribution. So we decided to make one -- and we want your help!

Today, Moonfire is releasing the Moonfire Tokenomics Research Platform - an open source dataset on the tokenomics of crypto projects.

It currently contains the token distributions of more than 60 of the largest gaming and DeFi projects. We envisage this number to grow substantially over time as new and exciting projects emerge, and current / past projects are added in.

We are open sourcing this repository for the benefit of researchers, investors, and web3 entrepreneurs alike. Moonfire is a strong supporter of open source software and data. We’ve chosen this path because we trust that with the help of the community this dataset will stay up-to-date and grow. We invite everyone to contribute and make enhancements.

Web3 projects often use different terminology to describe the recipients of tokens. And sometimes there is simply not that much information available. We made a concerted effort to categorise different methods of distribution into the following:

- Airdrops: some projects distribute tokens to early adopters of a project, to reward them for using it before any tokens were launched

- Ecosystem: a large proportion of tokens is usually reserved to grow the ecosystem. Anything that draws new users to the project, or binds them to it via long-term incentives and rewards is counted in this category. This could include staking & liquidity provision rewards and in-game prizes and incentives

- Investors: often tokens are sold strategically to partners, angel investors or VC funds prior to public offerings

- Public Sales: token sales open to the general public, i.e. ICOs (initial coin offerings), IDO (initial DEX offerings), launchpad sales and the like

- Team: founders usually take a reasonable stake of tokens. Often further allocations are made for early or future hires

- Advisors: a route to reward advisors for their time and expertise usually before a project becomes widely known

- Treasury: a general pool of funds that can end up being distributed via one of the above channels, used to generate returns for the project, or benefit the project in some other way long-term. Often governance token holders will make decisions about how the treasury is managed and how the funds are deployed

We have data on these 7 categories across 63 projects (30 from crypto-gaming and 33 from DeFi). The earliest project is from 2017, and we are adding new ones as we find them.

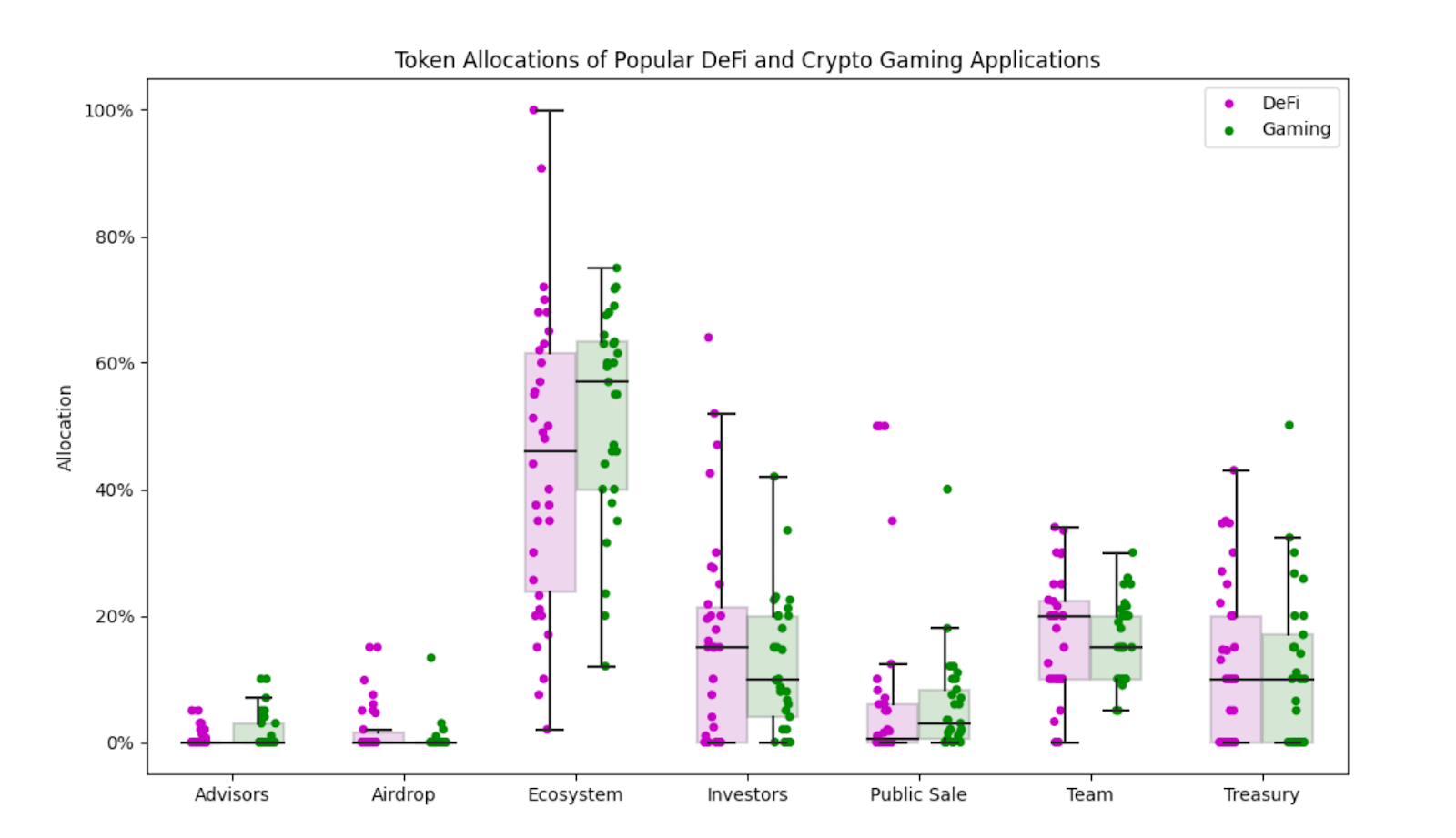

For a look at early findings, we can compare how initial token distributions for the 7 categories outlined above compare for DeFi and Crypto-Gaming projects.

The two sectors are surprisingly similar in terms of token distributions. Airdrops and advisors account for only a tiny proportion of tokens distributed, whilst funds attributed for the ecosystem are by far the largest pool of value. Additionally, on average a higher percentage of tokens is allocated to private investors than public sales.

But some notable differences: gaming applications tend to allocate a higher proportion to the ecosystem and public sales than DeFi and slightly less to investors and the team. This could be due to gaming companies understanding the power of creating token incentives to drive user growth and engagement.

We have also collected data on maximum supply and token governance rights. But in the interest of not overwhelming, we will sharing more graphs and findings on those variables in the near future!

Overall, the dataset in its current form is too small to draw strong conclusions. But one day we may be able to reasonably predict the viability of a project based on its whitepaper alone, before a testnet is even launched.

And to get to that point, we are open sourcing our data and asking the community for help with expanding it.

If you do want to help, the latest version of the dataset is available in csv format here. You can edit or add to the dataset by making a PR to our public repo here. As we’re only human, there might be errors in our dataset, so pointing those out would certainly be helpful.

Please do share it with others who may be keen to get involved. Always remember…

The Moonfire Galaxy Continues to Expand

Two further hires have bolstered the engineering team at Moonfire, which is now growing larger than the investment team! I am delighted to introduce you all to Francesco and Harpal.

Francesco is a machine learning researcher, engineer and developer who has worked as an academic at the frontiers of machine learning for almost 10 years. He holds a PhD and two postdoctorates in distributed algorithms for optimisation, machine learning and control and has published over 20 academic papers on topics in artificial intelligence and machine learning. Prior to joining Moonfire, Francesco was an AI Fellow at GlaxoSmithKline, where he led projects involving graph neural networks and equivariant architectures to analyse and predict the properties of molecular compounds.

Francesco joined Moonfire in early 2022 to drive the build out of the Moonfire evaluation engine for assessing companies and founders.

At Moonfire, he drives the evaluation engine for assessing companies and founders, and leads on the large ecosystem analysis models to make predictions about the entire global ecosystem.

Francesco is a long-distance runner, ex swimmer and cyclist, still planning to race in an Ironman at some point in the near future. He also has a formation in music composition, plays the piano (and some other exotic instruments like the Stick) and is often in theatres attending concerts.

Harpal is a data science specialist and tech entrepreneur with extensive development experience throughout the machine learning pipeline. He has held Lead Data Scientist and Machine Learning Engineer roles in London, at law firm Monaco Solicitors, and in Korea, in Samsung’s Core AI R&D Group, where he developed multiple aspects of the machine learning pipeline with a focus on adapting transformer-based language models (NLP). While at Samsung, Harpal also co-founded SpeakEasy - an AI-powered ed-tech mobile app, which he then sold to Samsung’s Core AI R&D Group.

Harpal joined Moonfire in late 2021 to deliver complex data analytics, particularly exploratory data analysis and core machine learning research.

At Moonfire, he builds unbiased AI algos to source the best co-founders and companies (regardless of race, class, etc.) and use my experience as a successful founder to help them realise their vision.

Harpal used to play the drums in a rock band, boxes to keep fit, doesn’t take life too seriously and loves a pint with good company. He’s consistently circled back to cause driven work, which resonates with him on a different level to the day-to-day grind in ‘big tech.’

PODCAST OF THE MONTH

Not so much a podcast, but our good friends over at Slush recently released Builders' Studio: a Founder School. It is a series of 30 half-hour videos covering all aspects of the founder experience, from initial pitching, to fundraising and scaling; all from people with personal experience.

QUOTE OF THE MONTH

“As one of my former bosses observed: “No strategy is better than its execution.”

— Frank Slootman

GOOD READS OF THE MONTH

The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze

Laura Shin

We picked this one up recently, and whilst we haven’t been able to get through all of it just yet, what we have read is thrilling. It reminds us that whilst technology may be changing the world, it is real people, with their own philosophies, beliefs and idiosyncrasies that make the difference.

Congrats to Laura on this gargantuan piece of work! We look forward to reading the rest.

And that’s a wrap - thank you for reading (and maybe for contributing!). We wish you all a great month ahead.

Best,

Mattias

🌓🔥