Seed is broken. Here’s how to fix it.

Seed is a different game now than it was 10 years ago, for both founders and investors. It deserves a rethink.

The term Seed is broken.

Today, it can mean everything from backing first-time founders with no product to investing in serial founders with significant traction, encompassing rounds from $500k to $6m plus.

Larger and later “Seed” rounds, coupled with recent big valuations, are clouding the true nature of many young startups. And in the pullback after 2021’s high water mark, expectations are higher than ever before, making it harder for young companies to make the ever-bigger jump to Series A and beyond.

How we talk about Seed-stage startups and funding deserves a rethink.

The explosion of Seed funding

Between 2006 and 2010, fewer than 3,200 startups received Seed funding; a decade later, 23,000.

Investors are now racing to get in first, with over nine times the firms active at Seed than there were a decade ago, according to Pitchbook data, and many multi-stage firms have created Seed programmes.

Seed funding used to serve as a relatively modest financial springboard, enabling typically pre-revenue startups to lay their foundations. That’s all changed.

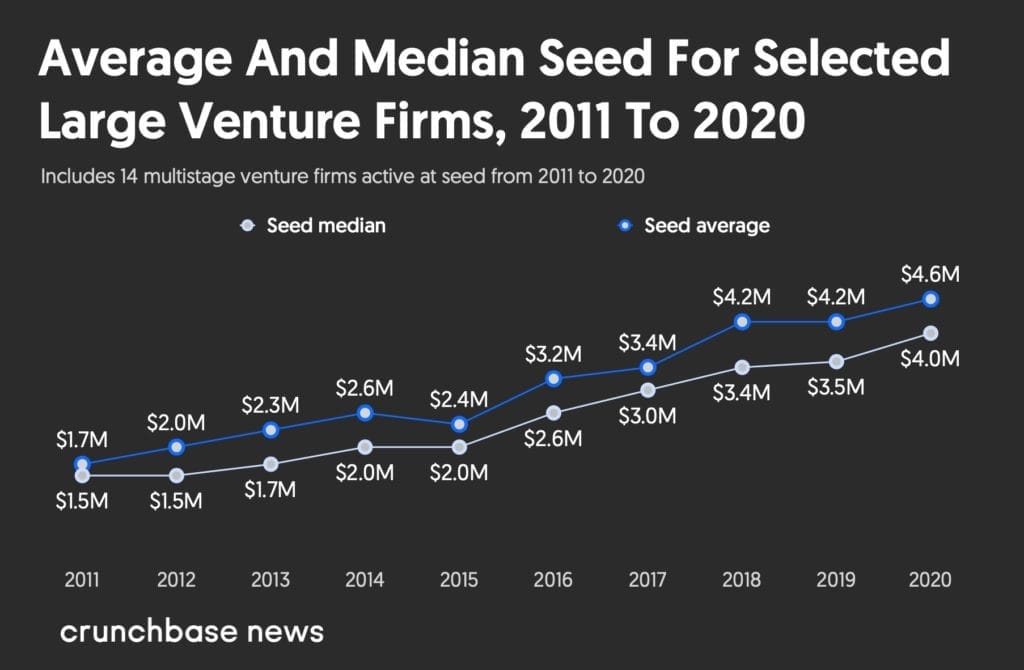

Between 2010 and 2020, the average seed deal grew from $1.7m to $4.6m – some upwards of $22m. Last year, 1,500 angel, pre-seed, or seed rounds were $5m or more, with some stretching into the tens or hundreds of millions.

At the same time, from Q4’23 to Q1’24, median seed deal sizes have grown by twice the size (17%) compared to Series A (9%). While median deal sizes of Series A remain near pandemic-level numbers, Seed deal sizes have grown by over 65% since then.

And in contrast to the declining median pre-money valuation for all Series A and later rounds from 2022 to 2023, Seed deals’ median pre-money price tag rose from $11m to $12m in 2023. Seed and Series A valuations are converging.

It’s fundamentally changing the dynamic of Seed-stage funding and how startups grow and raise. Pre-Seed is the new Seed, Seed the new A, and A the new B.

Older, wiser

Seed-stage companies are also older and have more traction than they used to.

The median age of companies funded at Pre-Seed is now 1.2 years old, according to Pitchbook. And startups are on average 23 months old when they raise a Seed round, according to data from Cendana Capital’s portfolio. A decade ago they were less than a year old.

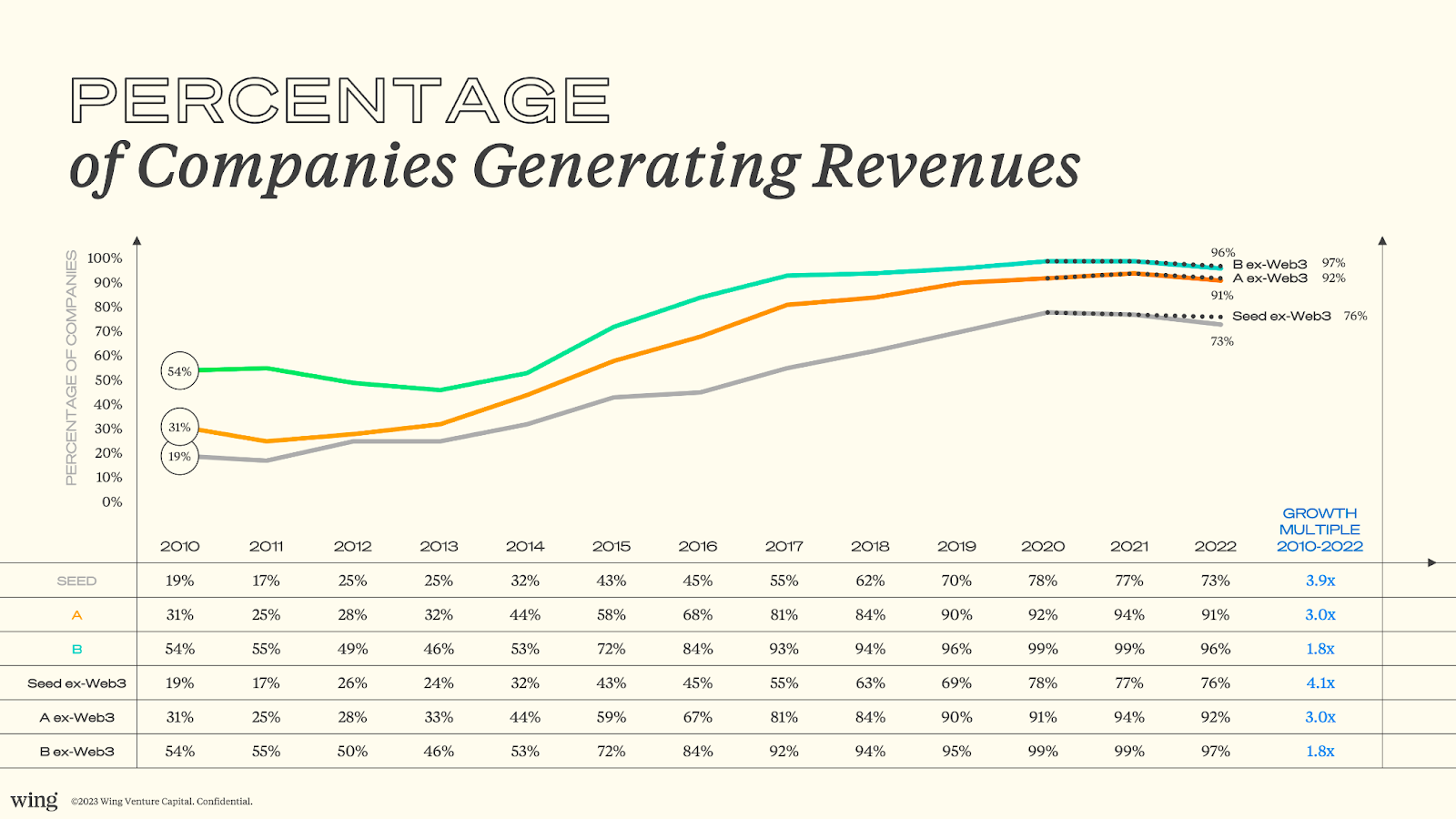

Take a look at this data from Wing Venture Capital:

In 2010, 19% of Seed-stage companies were generating revenue. In 2022, it was 73%. And it’s the same story for A (31% to 91%) and B (54% to 96%).

A Seed by any other name

All of this muddies the waters of what Seed-stage really is.

This is not just an observation of the larger amounts of capital raised, or the velocity of early-stage traction, but a recognition that often these startups are led by experienced third-time founders who have a head start with deep learnings, a strong network, and a powerful team behind them.

This means that startups, especially those led by first-time founders, now have to demonstrate significant traction to attract the same level of investment they might have achieved before. And the challenge is particularly acute for startups that secure Seed funding at the lower end, who then face a steep valuation climb to reach Series A and peers who have secured much larger Seed rounds.

It’s hard for a startup that raised a $500k Seed to compete with another that raised $4m at the same stage. Founders can also get trapped into over-diluting themselves early on, which can be hard to rectify in later funding rounds.

Scaling the cliff

The perceived ‘step up’ from Seed to Series A is now equivalent to scaling a sheer cliff face. It’s no wonder the percentage of Seed stage startups able to advance to Series A within two years has dropped – from 23% for the 2020 cohort to just 5% in 2022.

While high failure rates indicate higher quality startups coming out the other side, there’s also a risk that some are falling through the cracks, simply because their growth is being misunderstood and poorly categorised by investors who are setting unrealistic targets for valuation and growth. Early metrics for successful development should include the Googles, Notions, and Facebooks of the world that took time to mature their products and monetise.

Seed has become an increasingly significant and elongated phase in a company’s early life cycle, often raising multiple million-dollar Seed rounds. The median time from a $1m+ seed round to Series A has increased from 14 months in 2014 to 28 months in 2023. And, like Seed, Series A rounds have got much larger – $20m+ Series As are now the norm.

The proliferation of terms like ‘post-seed’, ‘seed plus’, ‘A minus’ and ‘early A’ reflects an industry grappling with these changing dynamics. But these labels obscure the real progress and needs of young startups. They still define a company by the quantum being invested rather than where a company is in their growth journey.

We need language that accurately captures the specific challenges and milestones of young startups at each phase of their journey.

The 2 stages of Seed

Ed Sim at Boldstart Ventures recently coined “Inception Rounds” to redefine what first money in really means in this new world, describing rounds that occur before incorporation and range from $2m to larger than $6m.

It’s a valuable framework, but there’s room to expand it, thinking about the specific stage and needs of the company, not just the amount and timing of the funding.

The temptation is to reclassify it all – but I didn’t want to create something too detailed, too fragile for an industry whose milestones change with each cycle. It would quickly become irrelevant.

I wanted a simple, useful heuristic, so I propose categorising Seed into two distinct groups: Seed Inception, which Ed Sim describes well as initial ticket going in, and Seed Expansion, which describes rounds where founders have already achieved some milestones and metrics.

1) Seed Inception 🛠️

The very beginning of the journey, perhaps before the founders have formally established the company.

They’re rapidly iterating the product and making the first critical hires – usually engineers, product people, and designers. These early decisions set the standard and ethos of the business.

With around five customers, they’re in a critical period of concept and technology refinement to define the product. The focus is on developing an MVP through testing, analysis, and feedback, iterating closely with handful of users or customers who are the early champions.

The founders must avoid the trap of endless iteration. It’s about building with conviction and with an eye to scale, while ensuring the solution is grounded in real user needs and feedback.

This phase can look different depending on the founding team.

- Discovery (<$2m): Aimed at first-time founder teams who have the scaffolding of a product with a bit of testing and could have had discovery meetings with potential customers. Founders benefit from mentors to navigate a path to ensure they can get out the door at pace.

- Classic ($3-5m): Suitable for a first- or second-time founder who has validated their product concept.

- Jumbo (>$6m): Reserved for serial founders with a proven track record, ready to scale aggressively.

2) Seed Expansion 💥

At this point, the founders have raised a previous pre-seed (Seed Inception) round to start building and get their first customers. This is a round where they’ve already proven their stripes. The jump to a Series A is a large one for Seed, so having two rounds of funding makes sense and it continues to double or more the valuation of the business. It lends itself to the increments of value growth at each round that make sense in venture.

Having launched the product, the focus is now on iteration and go-to-market testing. The team is small, anywhere from five to 15 people, but might have the beginnings of a sales team, supporting the founder in driving revenue. Pricing is probably still a bit nebulous but the founders have tried various pricing models and now are getting a good idea of what the market wants.

We find many multi-stage investors are more comfortable entering Seed with first-time founders at this point, when there’s traction and the team has been building for a while. They favour a Seed Expansion round – unless its a serial founder with a proven track record, when they’re happy to go in at Inception.

This phase can look different depending on how the team has done a pre-seed or Seed Inception raise.

- Classic ($3-5m): Typically follows a pre-seed for startups that have hit commercial traction but are still in the early days: heavy product iteration mode and figuring out their go-to-market. The team remains small but extends beyond the original founders in engineering and product, maybe with junior sales reps helping the founders on commercialisation.

- Jumbo (>$6m): Suited to more established startups, progressing from Seed Inception and focused on scaling rapidly with a community of champions. It’s all about continuous delivery and making sure things don’t slow down. The team is deadly focused on scaling the business, driving product development and sales simultaneously.

So what?

Founders can use the above framework as both diagnostic and roadmap. Orient yourself and set your operational priorities; know where you are and where you’re going.

For investors, it provides a more granular understanding of where a Seed-stage startup is at so they can tailor funding and support, align on priorities and expectations, and help founders navigate their early stages of growth more effectively.

By focusing on the progress of the company, investors and founders can re-orient the company, raise, and valuation back to the fundamentals: level-setting capital against where the company’s at on its journey and clarifying what the capital should be spent on. You can also better judge burn rate, pegging it to the level of product-market fit, not how much cash is in the bank.

This approach also bakes in a more nuanced approach to risk, tranching capital to match immediate needs and long-term milestones, and moving away from thinking in terms of the optics, quantum, or established nomenclature of rounds. It’s like building software. Focused, incremental improvements; not leaping from inception to scale.

By recognising the various paths of Seed-stage startups, we can offer more meaningful support and help founders not only reach but excel to Series A and beyond.

That’s how we’re thinking about it. I’d love to know what you think.

– – –

Thanks to Matt Robinson (Founder, Angel, and Partner at Accel), Tom Tunguz (Founding Partner of Theory Ventures), Crissy Behrens (Principal at Insight Partners), and Ed Sim (Founding Partner of Boldstart Ventures) for reading drafts of this.